J. Cole Doesn't Care About Poor People. [BRACKETS]

Taxes, J. Cole, Philanthropy, and Social Contracts

![J. Cole Doesn't Care About Poor People. [BRACKETS]](/content/images/size/w2000/2020/12/cole-kod-600-600_hq-1.gif)

While K.O.D is not my favoriteeee Cole album, Brackets is and always will be a standout. We get Jermaine at his best, reflecting on the ways of the world and offering his unsolicited criticisms. Back in April of 2018 when I heard this song, I knew it would inspire an article almost immediately. And now that 2020 is coming to an end as we get our second round of stimmies it got me thinking about our taxes and how they get spent alll over again.

I'll write a check to the IRS, my pockets get slim

Damn, do I even have a say 'bout where it's goin'?

Some older nigga told me to start votin'

I said "Democracy is too fuckin' slow"

If I'm givin' y'all this hard-earned bread, I wanna know

Better yet, let me decide, bitch, it's 2018

Let me pick the things I'm funding from an app on my screen

- J Cole in Brackets, circa 2018

In the verse posted above, we see a pretty straight-forward solution to a fundamental issue that many people I know can relate to. We don't know what the hell the government is really doing with our tax dollars- but we have a hunch that whatever it is, it's not benefitting us in the ways we would want.

So, logically, Cole posits that individuals should be able to choose how each and every dollar of our taxes get spent. Whether or not he was serious, I honestly don't know, but the verse got me thinking... What would something like that actually look like? Does the Constitution even allow this? Who would build the app?

I didn't know the answer to any of these questions, so I enlisted the help of the internet and a few people much smarter than me.

My research consisted of:

- basic reading around taxes

- watching this Patriot Act episode

- becoming unreasonably angry about Robert Smith's philanthropy

- texting some of my law school friends.

During my internet research I came across this archived tax receipt calculator. It was a tool provided by the government to calculate exactly where your money was going.

That webpage link is now dead and only available through the wayback machine. Tragic. While there are still some 3rd party people offering tools to calculate your tax receipt, it's not clear why the government got rid of the official .gov one.

What Would Paying Our Taxes From Our Phone Actually Look Like?

Let's say we could actually do exactly what J. Cole suggests. Pick the things we're funding from an app on our screen... BAM!

As I'm thinking about how this would work, I'm imagining how people's experiences would impact their distributions. The person who is worried about the whitewashing of their child's education might have a very different point of view on how their taxes should be distributed than someone who's main worry is that their kids' spots at Ivy League schools are being taken up by affirmative action candidates. Yet another person might feel as if the United States is not doing enough to promote democracy in other parts of the world and thus wants to contribute all of their tax money to the defense line item in the national budget.

You can see where this is going. A software application like the one designed and shown above might enable each and everyone of us to choose exactly where each cent of our tax dollars went. A True Democracy Oligarchy! Which is what we all want.. right?

Ok, That's a Fancy App, Sure - But Could This Ever Happen?

That's an excellent question. We got our resident legal & political scholar (we'll refer to them as LPS from now on) to stop by and speak about the feasibility of this modest proposal and dive into why people seem to think that the current process for policy change is so slow.

We've reproduced the interview below... lightly edited for clarity.

Juice County Prodigy (JCP): First things first.. Good idea or Bad idea?

Legal & Political Scholar (LPS): Bad idea... for a lot of reasons. The overarching issue is that it's anti-democratic and counter to the essence of what taxes are. A tax is an obligation that's a part of a social contract.

JCP: How is that? Tell me more.

LPS: Well, in a democratic society, people - through their representatives - set the measure of what they think is a fair allocation of the tax burden and through that we create the social safety net to help combat general inequality.

JCP: Right, that part makes sense to me - so what are the issues you see with individuals setting that allocation by themselves via that app we looked at previously?

LPS: Well your representatives are responsible for setting the allocation for what they think is important. There are a lot of competing factors that go into that allocation - incentivizing innovation, incentivizing hard work, incentivizing risk taking through investing, generating efficiencies and wealth for society - but on the other side of that they also are hoping to still ensure some minimum standard of living via these distributions. Tax revenue allows for a number of programs to operate to the extent that you want to create national goods like the military, interstate highways, and other things that require the pooling of resources.

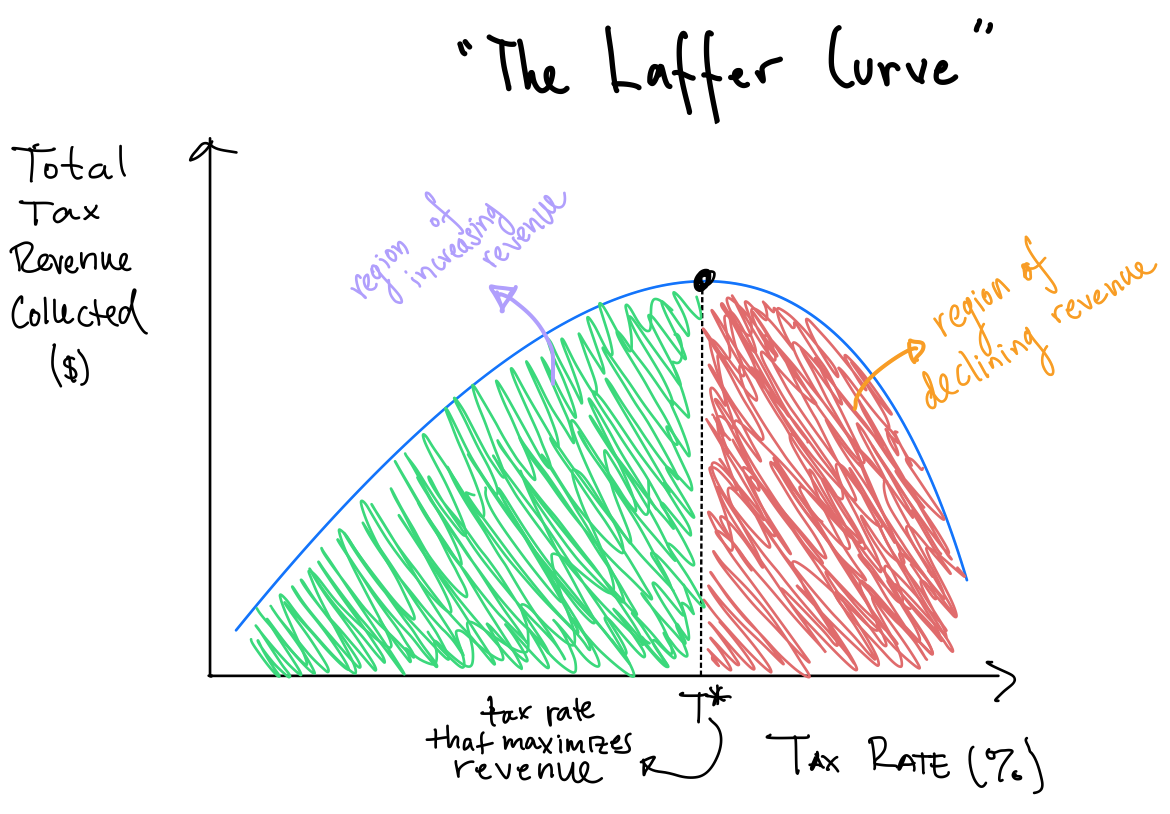

an aside - our LPS' discussion of tradeoffs with taxes and work/investment incentives alludes to The Laffer Curve, shown below.

LPS: So - the app you prototyped would skirt that wholeee process of balancing those competing goals.. By giving individuals that responsibility instead of a central body of representatives it's really no different than having philanthropic interests. The extreme result would be as if we didn't have taxes at all and you get people basically donating whatever amount they see fit to which ever causes they see fit. And I think there are a host of criticism associated with that approach.

JCP: Okay thats fair but what do you say to the people who think the representation that we have in government has been wildly inefficient and fraudulent stewards of our tax dollars?

LPS: I think the response to that is if you don't like the decisions that people are making - then get new decision makers! So elections are the most fundamental solution there. Or having better accountability measures in place to make sure your representatives are representing you. That's political power 101. But that point aside, I think pragmatically there's also the point of comparison - even if you don't like the current system you still have to think about if a system like this would be an improvement in someway?

Let's assume for a second that you're someone with even slightly progressive values and you thought that race and class were areas that needed more consideration in our national decision making processes. Then this would be an absolute disaster. The less money you made - the less say you would have. Yet if you were more of a pro-market, libertarian, small government, survival-of-the-fittest social Darwinist, then you'd have more reason to support something like this. People paying a disproportionate amount of taxes because of their high income & tax brackets might find this idea attractive and would probably spend more money on incentivizing the types of line items that would create more opportunities for large corporations and creating a more business-friendly environment.

But if you are someone who wants to combat economic inequality and racial disparities then I don't see how this could possibly be an attractive option. If you think the government is wasting money on poor people then maybe this is something you would want.

JCP: So you're saying that J. Cole doesn't care about poor people?

LPS: 🙄 I'm saying he doesn't understand tax policy.

JCP: 😅 alright i'll take that, ionno what he studied at St. John's but I guess that wasn't it.

JCP: Let's assume that U.S businesses had the same type of system for allocating taxes that we saw above, what do you think that would look like?

LPS: That's easy. Corporations would be sending all of their tax-revenue line items to try and prop up their industries and put more back in their pockets.

JCP: And if you think about it.. this is kind of already happening - Amazon's paying minimal taxes but they are definitely lobbying for particular policies that ostensibly align with their corporate interests.

LPS: Exactly - and super wealthy individuals are kind of already living this life to be honest. Tax rates on the wealthy were approaching 90% (!!) at the time of WWII or during Franklin D. Roosevelt's time, whereas today the ultra wealthy top marginal rates are closer to 36% (ignoring capital gains tax rates), which means the wealthy have much more money to spend and thus have the power to allocate their money through large foundations to dictate where that goes. And there's a lot of scholarship already criticizing this ability for really rich people to essentially create policy as opposed to the representatives elected by the population. To me, the only solution is to tax the income.

JCP: So to a certain extent you're telling me that for the wealthiest people this is kind of already happening? I want to circle back to the philanthropy piece we touched on earlier - While we know Robert Smith has been evading taxes - he also wiped out some student debt at Morehouse, so what about the times when we like what rich people do with their money?

LPS: Well to be fair there are certain things that just aren't attractive to governments to fund. Overseas and international medical aid in the developing world for instance is not vigorously supported by the US government. The arts, oftentimes are not super high priority for the national government, so maybe those are more appreciable gaps that make sense for ultra-wealthy people to fund. But you still have to answer the question - are the people who have amassed vast fortunes the ones who should be in charge of deciding where that money goes. Is there alignment in their values and those of the greater society? Is there a net positive to having philanthropic endeavors versus federal funding? This is really the classic individualistic versus communal ethos debate that has and will continue to rage on for what seems like all of eternity.

JCP: This has been really informative - appreciate you taking the time to talk. Any last things you'd want to add or touch on?

LPS: Yes! A few months back Cardi B mentioned something on Instagram about Tax receipts.. now thats not a bad idea, we do in general need much more transparency in what is happening. There's been a lot of research around people having really terrible instincts about where federal funds are going so maybe this would help with that - the motive resting on the idea that the more informed we are as a populace, the better decisions we would make.. although some might say that's still a debatable proposition.

So there you have it - from J. Cole to Cardi B to Robert F. Smith we should all care deeply about the taxes we pay, the decisions surrounding how they get allocated, and the violations of basic social contracts that corporations and philanthropists alike try to pass off as altruism & good will.

👁Stay Woke👁

As Always, Thanks For Reading, Mess with us in the comments & Smash that Subscribe Button 🤣

P.S - If you're getting this in an email please forward to a friend who you think might like it!

P.P.S - If you really really f with this - please support us on Patreon.. and by us i really mean me... just a young Black man burning the midnight oil the day after Christmas to bring you nothing but the hits..

Sources and Footnotes

- The wayback machine is a product maintained by the Internet Archive non-profit that helps catalogue the internet in all of its glory and in some ways fights misinformation by keeping a history of webpages and how they change over time.

- Tax Receipt web page stored in the web archive from April 3, 2012

- Extra reading at Investopedia on the Laffer Curve and its many flaws and implications

- Open Secrets - Amazon's lobbying expenditure in 2019

- Robert Smith been hiding his money from Uncle Sam - given his philanthropic track record, should we care?

- Our expert also noted that this whole article ignores the practical and logistical issues associated with an uncoordinated decentralized allocation. If I knew that as a nation we had already budgeted $10B for education, then I might change my allocation. Since these decisions would all be made independently it would be really hard to optimize as effectively as a single body with decision making power could.

- Cardi B had a plea for transparency on Instagram in 2018 that she has since taken down. Thankfully it was captured by CBS News. Top notch journalism.

Comments

Sign in or become a &computers member to join the conversation.

Just enter your email below to get a log in link.

Member reactions

Sign in to leave reactions on posts